W4 calculator 2020

Then simply click Create W-4 and you are done. W4 Calculator for calculating how much federal income tax youre going to withhold during the course of the tax year.

How To Calculate Federal Income Tax

3 4 Key Takeaways Your entries on Form W-4 the Employees Withholding Certificate determine how.

. This option gives the employee the most accuracy and. How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Free salary hourly and more paycheck calculators.

Our free W4 calculator allows you to enter your tax information and adjust your paycheck. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4. This will give you an idea of whether or not you will owe to.

The new version of Form W-4 has been effective since the 2020 tax year. For example if an employee earns 1500. Employers can use the calculator rather than manually looking up.

Up to 10 cash back Maximize your refund with TaxActs Refund Booster. The United States Annual Tax Calculator for 2020 can be used within the content as you see it alternatively you can use the full page view. Get your taxes done.

The Form W4 provides your employer with the details on how much federal and in some cases state and local tax should be withheld from your paycheck. Median household income in 2020 was 67340. 2020 Form W-4 Questions and Answers Form W-4 Employee Withholding Certificate Form W-4P Withholding Certificate for Pension or Annuity Payments Notice 1392.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding. Our free W4 calculator allows you to enter your tax information and adjust your paycheck. You dont NEED to fill one out if youre.

Thats where our paycheck calculator comes in. Welcome to the W4 Calculator. Estimate your federal income tax withholding.

Even though the design of the form W-4 does not enable a taxpayer to enter a fixed IRS tax withholding dollar amount the W-4-Check calculator is created to let you do just that. W4 Calculator Renewal plus Network Upgrade. 250 and subtract the refund adjust.

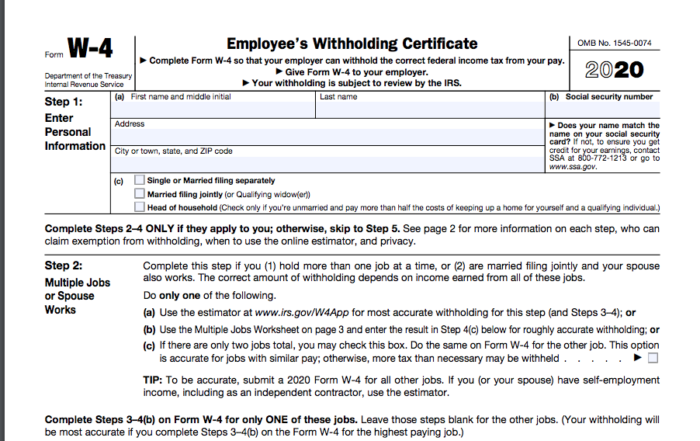

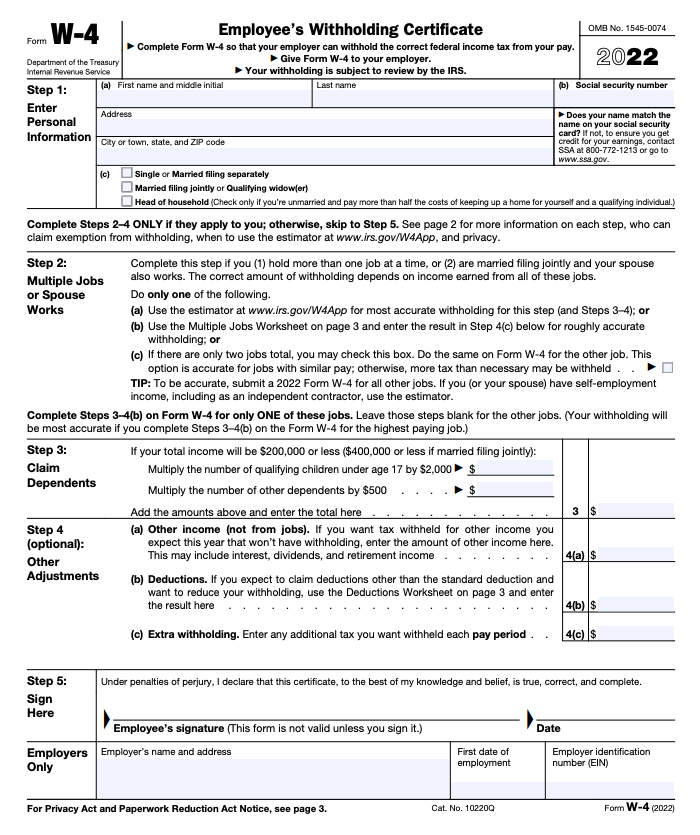

2020 W4 Calculator Available Taxes TLDR. This is handy if you are flicking between different. W-4 2020 Employees Withholding Certificate Department of the Treasury Internal Revenue Service Complete Form W-4 so that your employer can withhold the correct federal income tax.

W-4 IRS Withholding Calculator IRS Withholdings Calculator To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator. 1400 take that refund amount and divide it by the number of months remaining this year if we are in May you would have 7 months left June -. Lets go through the three options.

This is Step 2a on the form. The IRS rolled out a new W4 EstimatorCalculator for tax withholding to align it w the revised tax laws. The new W-4 introduced in 2020 still asks for basic personal information but no longer asks for a number of allowances.

Option 1 this is to use the Tax Withholding Estimator on IRSgov. The tax withholding calculator can accommodate. IRS tax forms.

November 25 2020 930 AM. For example if you received a tax refund eg. Our free W4 calculator allows you to enter your tax information and adjust your paycheck.

Before you start using the tax withholding calculator make sure that you have a completed Form W-4 from your employee. That prompted the IRS to change the W-4 form. Tax withholding is the money that comes out of your paycheck in order.

Up to 10 cash back Maximize your refund with TaxActs Refund.

The New Form W 4 Form Is Different Really Different Asap Accounting Payroll

A New Form W 4 For 2020 Alloy Silverstein

W 4 Form What It Is How To Fill It Out Nerdwallet

Federal And State W 4 Rules

Irs Releases New Form W 4 And Online Withholding Calculator Personal Wealth Strategies

W 2 And W 4 What They Are And When To Use Them Bench Accounting

Mobile Farmware Irs Form W 4 2020

Irs Improves Online Tax Withholding Calculator

Free W 4 Calculator Tax Withholding Info For Hr Professionals Goco Io

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

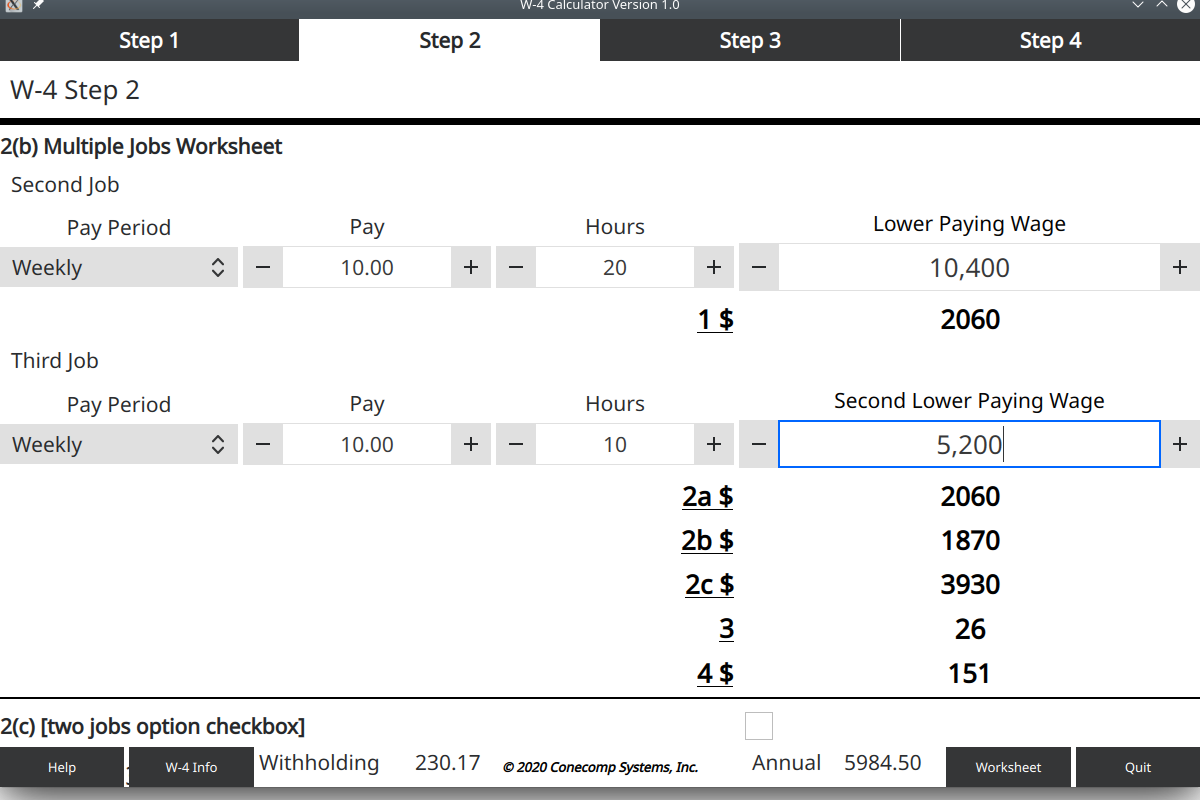

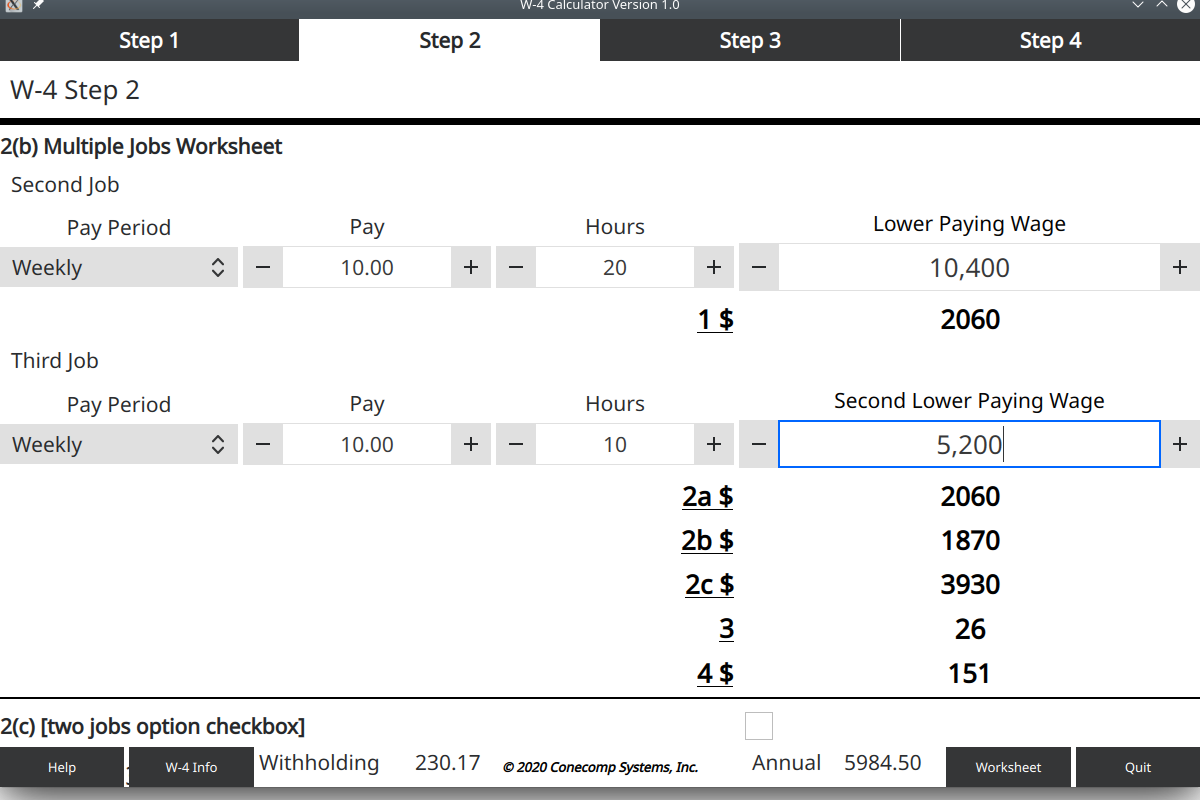

Conecomp W 4

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Conecomp W 4

Learn About The New W 4 Form Plus Our Free Calculators Are Here To Help Paycheck Manager

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

W 4 Form Basics Changes How To Fill One Out

Test Your Knowledge Of The Irs Tax Withholding Estimator Bds Financial Network